nj tax maps free

The taxes for the. See notation on yearly bill.

How Do State And Local Corporate Income Taxes Work Tax Policy Center

February 1st May 1st August 1st.

. January 1st April 1st July 1st. The Tax Collector is responsible for the billing collection and reporting of taxes for all non-exempt Township properties. The properties sold at the tax sale are those with delinquent property taxes andor municipal charges.

The Borough of Oakland will hold its annual online accelerated tax lien sale in December. Property taxes are based on the assessors valuation of real property and levied for the calendar year. Additionally we bill collect and report sewer user fees for all properties within the Bernards Township Sewerage Authority area.

2022 Beach Badges Photo Bernie Hubert. No grace period A discount of 400 will be given if sewer bill is paid in full a year in advance by July 1st of each year. In New Jersey all municipalities are required to hold at least one tax sale per year.

The Tax Collectors Office must follow state statutes. The last day to pay 4 th quarter taxes is.

How Do State And Local Individual Income Taxes Work Tax Policy Center

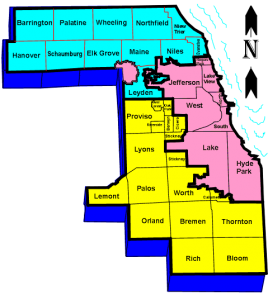

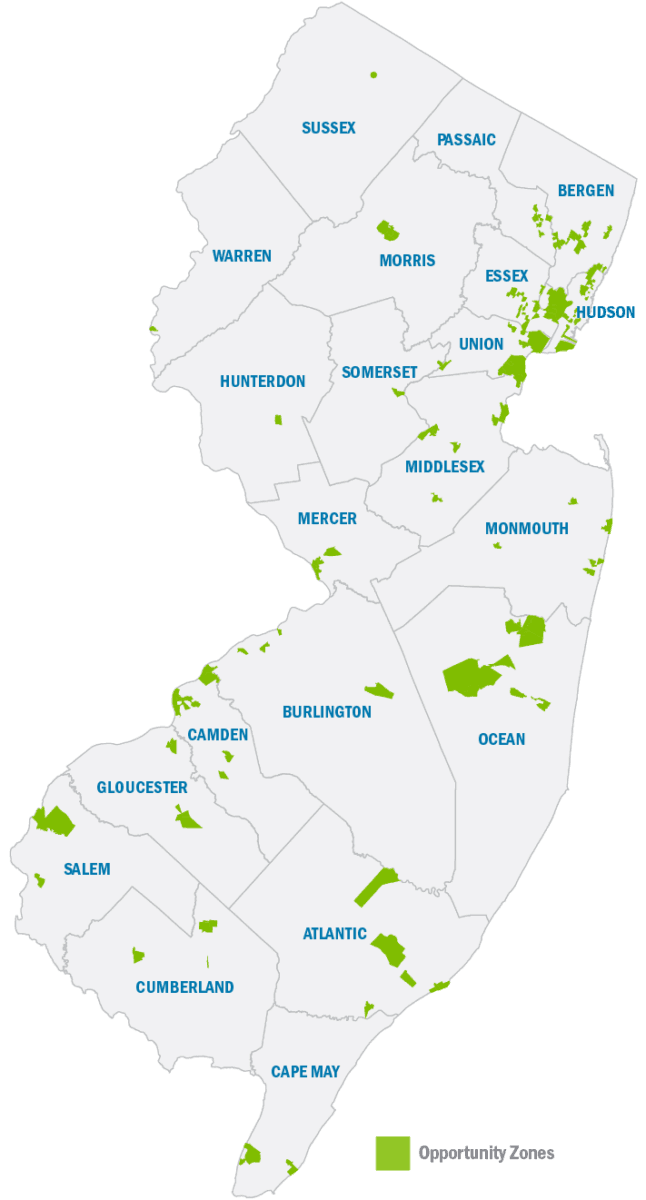

Opportunity Zones In New Jersey Choose New Jersey Inc

State Income Tax Rates Highest Lowest 2021 Changes

Nj Data And Municipalties New Jersey Information Research Guides At New Jersey State Library

Historical Bergen County New Jersey Maps

Historical Bergen County New Jersey Maps

Tax Maps And Valuation Listings Maine Revenue Services

Amazon Com New Jersey County Map Laminated 36 W X 43 19 H Office Products

Historical Hudson County New Jersey Maps

Parcels Composite Of Nj Download Njgin Open Data

New Jersey Retirement Tax Friendliness Smartasset

New Jersey Retirement Tax Friendliness Smartasset